Preparing and submitting an invoice

If you have supplied goods or services to Hydro‑Québec or Société d’énergie de la Baie James (SEBJ), here’s how to prepare and submit an invoice.

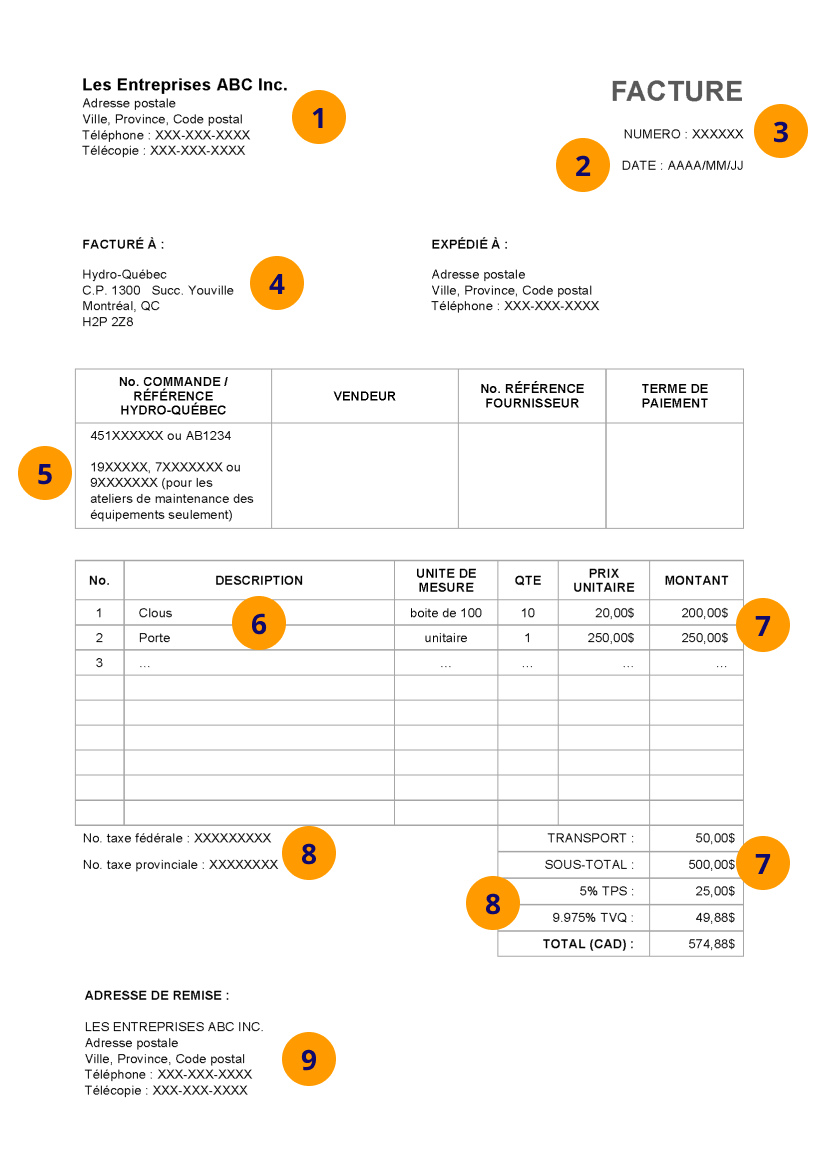

Preparing an invoice

-

Company’s name and address

The information provided must be the same as in the Registre des entreprises du Québec (REQ) and on your contract or purchase order.

Make sure the supplier’s name on the invoice is the same as the one on the purchase order. If a third party delivered the goods or rendered the service, please contact the Info‑Acquisition Line to let us know.

- Invoice date

-

Invoice number

If you send us a credit note, you must indicate the initial invoice number to which the credit note applies.

-

The recipient of your invoice

Address your invoice to Hydro‑Québec or Société d’énergie de la Baie James (SEBJ), as the case may be. Any other wording will result in your invoice being rejected.

-

One of the following references

You must include one of the following references on your invoice:

-

Purchase order number:

- 10 digits, starting with 45 (if you have a blanket contract, the contract number is also required)

- 7 digits, starting with 9XXXXXX or 8 digits starting with 19XXXXXX or 7XXXXXXX, for vehicle maintenance shops only

-

Alphanumeric reference:

- CII – an internal ID for employees (2 letters followed by 4 digits)

Important! If you haven’t received one of these reference numbers, contact the person who requested the goods or services in order to request one.

-

-

Description of the goods or services provided

Taxable and non-taxable items must be indicated separately.

You must ensure that the purchase order includes all items to be invoiced (delivery charges, environmental charges, surcharges, packaging, deposits).

You may only submit an invoice for goods delivered or services rendered, even if this results in several invoices for the same purchase order. This will avoid payment delays.

-

Invoice amount

You need not indicate any holdback amount on your bill. It will be applied in accordance with the terms of your contract or purchase order.

-

Applicable taxes with registration numbers

Taxes apply to the subtotal before the contractual holdback.

If you are registered to collect GST/HST under the Canadian government's simplified system or QST under the Québec government's specified system, you cannot collect these taxes from Hydro-Québec as Hydro-Québec is registered under the Québec government's general system.

Here are Hydro‑Québec’s GST and QST numbers:

GST: 119449775 RT0001

QST: 1000042605 TQ0020 - The address where you would like to receive payment

Do you need to submit a corrected invoice?

-

Prepare and send a credit note that replaces the

incorrect invoice. It must include the following information:

- The credit note number must be different from the invoice number.

- The credit note must indicate the number of the invoice to be cancelled.

- The credit note must indicate the reference number stated on your original invoice.

-

Prepare and submit a new invoice, by selecting one of

the following two options:

-

Use the same invoice number and add “CORR” after the number

or - Create a new invoice with a different number from the incorrect invoice and write the number of the incorrect invoice.

-

Use the same invoice number and add “CORR” after the number

- Prepare a new invoice after making the changes requested.

-

Submit the new corrected invoice.

Important! You do not need to send us a credit note if your invoice has been deleted (invalidated).

Submitting an invoice

-

Send your invoice to Hydro-Québec or Société d’énergie de la Baie James (SEBJ) by e-mail to: comptes.fournisseurs@hydro.qc.ca

This email address is used exclusively to receive invoices and credit notes. Any other documents received using this email address (account statements, etc.) will be destroyed.

-

The invoice, which must be sent as an email attachment, can be

a PDF file (preferably text or image), a TIFF file, with a

minimum resolution of 400 dpi, a Word file or an Excel file. Please take

the

following details regarding the attachment into account:

- It may have several pages.

- Each attachment must consist of only one invoice but can include supporting documents (any supporting documents must be included below the invoice in the same attachment and in the same file).

-

You must send the email directly from a valid email address that can also receive email messages.

Important! Do not send your invoice from a “do not reply” address. The sender’s address is used to inform you if an invoice is rejected.

- The email should not include logos, images or hyperlinks.

- The email may include several attachments.

Once you’ve sent your invoice, you’ll receive an acknowledgment of receipt. Please keep the number you receive, as you will need it to follow up on your invoice.

You can provide a hard copy original of the invoice for up to seven years from the invoice date or three years from the end of the contract, whichever is later.

Would you like to receive your money more quickly?

Register for direct deposit and receive your payment more quickly. You will receive a deposit slip by email to inform you of the upcoming payment. It’s a quick, safe and environmentally friendly process.

Register for direct deposit

Frequently asked questions

If an amount that did not appear on your purchase order was included on your invoice and a notice of adjustment was sent to you, please contact your client at Hydro‑Québec to confirm that this expense is authorized and, if so, ask them to adjust your purchase order accordingly.

For unpaid items or services, a new purchase order must be issued.

For requests concerning an incorrect payment, you must complete and submit the form entitled Inquire about payment.

If you have signed up for direct deposit, you will receive a notice via email at the address you provided when you enrolled.

If you did not sign up for direct deposit, a notice will be sent to you at the mailing address we have on file.

No, only one email address is allowed.

Since holdback release requests must be made by your client at Hydro‑Québec, you must contact that person to ask him or her to take the necessary steps. Your client’s name and contact details are indicated on your purchase order.